In the New Income Tax Slab for the financial year 2020-21 assessment year 2021-22 an option is given to individuals or HUF either continue the existing income tax slab rates applicable in FY 2019-20 or opt a new income tax slab 2020-21 in India according to the new income tax regime.

To

know last year Slab rate: Income Tax Slab FY. 2019-2020 (AY. 2020-2021)

What are new Income Tax Slab 2020-21 (A.Y. 2021-22) in India?

Comparison

of old income tax slab applicable in FY 2019-20 and new income tax slab

applicable in FY 2020-21.

New Income Tax Slab rate 2020-21 for individuals below 60 years of age.

New Income Tax Slab 2020-21 for senior citizens of age 60 years or more but less than 80 years.

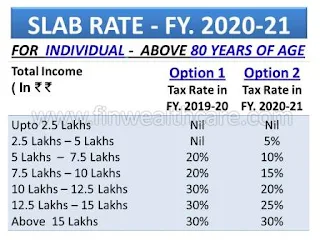

New Income Tax Slab 2020-21 for senior citizens of 80 years or more.

So,

for calculating income tax for financial year 2020-21 (assessment

year 2021-22) an individual has the option to either continue with

existing income tax slab 2019-20 or go for new income tax slab 2020-21.

Which tax slab is beneficial?

One

should calculate tax according to old income tax slab 2019-20 as well as new

income tax slab 2020-21 and by comparing both income tax slabs decide which is

more beneficial for you.

After

calculating tax according to the slab rate an additional tax is levied as

surcharge.

The

surcharge for the financial year 2020-21 is the same as applicable in financial

year 2019-20.

|

Income

(Rupees) |

Rate

of Surcharge |

|

Above 50,00,000

but upto 1 Crore |

10

% |

|

Above 1

Crore but upto 2 Crores |

15

% |

|

Above 2

Crores but upto 5 Crores |

25

% |

|

Above 5

Crores |

37

% |

Education Cess for FY. 2019-20 and FY. 2020-21.

After

this additional cess is levied of 4% for health and education cess.

Rebate [section 87A]

A

resident individual whose total income does not exceed rupees 500000 is eligible for

rebate.

The

amount of rebate shall be least of the following:

- Tax calculator (before cess) or

- Rupees 12500.

What are the conditions for opting new income tax slab 2020-21?

Salaried individuals having no business income will have to choose between the option of slab every year. It's not the situation that if you follow a particular slab in a year, you have to follow it for all the next year.

But in case an individual is having business income then he has to

choose carefully because once he chooses the option he has to follow the same

option for all the next years. He can switch back to the existing tax

regime only once in a lifetime.

If

an individual is opting for a new slab then he has to forgo most of the

exemptions and deductions.

What are the

exemptions and deductions under budget 2020 that are not available if you follow the new tax slab for financial year

2020-21?

List

of main exemptions and deductions that the taxpayer will have to forgo:-

- Leave travel allowances.

- House rent allowances.

- Standard deductions of rupees 50,000 to salary taxpayer.

- Deduction under section 80TTA (Interest on deposit in saving account) and Section 80TTB (Interest on deposit for senior citizens).

- Deduction of entertainment allowances (for government employees) and employment / professional tax.

- Interest paid on housing loan.

- Deduction under section 80C (like investment in PF, NPS, Life Insurance Premium, Home loan principal payment, School tuition fees etc.).

- Medical insurance premium (section 80D)

- Other special allowances (section 10(14))

- Conveyance, Helper allowances etc.

However,

deduction under sections 80CCD(2) (Employer contribution to NPS on account of

Employee) and section 80JJAA can still be claimed.

Income Tax Slab Rate for Companies

Tax

rates applicable for Domestic Companies, Foreign Companies, Co-operative

Societies, Partnership Firms and Local Authorities.

Domestic Companies (FY. 2020-21)

(a) If Gross Turnover upto 400 Crores in the previous year

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Flat

Rate 25 % |

Annual

Income (Rupees) (a)

Between 1 Crore – 10 Crores - 7 % (b)

more than 10 Crores - 12 % |

4

% |

(b) If Gross Turnover exceeding 400 Crores in the previous year

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Flat

Rate 30 % |

Annual

Income (Rupees) (a)

Between 1 Crore – 10 Crores - 7 % (b)

more than 10 Crores - 12 % |

4

% |

OR

New Tax Slab

Domestic

company has option to choose the reduce rate in new tax regime.

Section 115BAA (Domestic Companies)

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Flat

Rate 22 % |

10% |

4

% |

Section 115BAB (Manufacturing Companies)

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Flat

Rate 15 % |

10% |

4

% |

But for opt New Tax Rate certain exemptions and deductions in not available.

Co-operative Societies (FY. 2020-21)

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Slab

Rate Upto 10,000 -

10% 10,000

- 20,000 - 20% Above 20,000 -

30% |

Annual

Income (Rupees) More

than 1 Crore - 12 %

|

4

% |

OR

New Tax Slab

In

new tax regime Co-operative societies has options to choose reduce rate under

section 115BAD.

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Reduced

Rate 22% |

Annual

Income (Rupees) More

than 1 Crore - 12 % |

4

% |

But if you opt for new tax rate then you have to forgo exemptions and deductions.

Foreign Companies

(Same for FY. 2019-20 & FY.

2020-21)

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Flat

Rate 40 % |

Annual

Income (Rupees) (a)

Between 1 Crore – 10 Crores - 2 % (b)

more than 10 Crores - 5 % |

4

% |

Partnership Firms and Limited Liability Partnership (LLP)

(Same for FY. 2019-20 & FY.

2020-21)

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Flat

Rate 30 % |

Annual

Income (Rupees) More

than 1 Crore - 12 % |

4

% |

Local Authorities

(Same for FY. 2019-20 & FY.

2020-21)

|

Tax

Rate |

Surcharge

rate for companies |

Cess |

|

Flat

Rate 30 % |

Annual

Income (Rupees) More

than 1 Crore - 12 % |

4

% |

Post a Comment

If you have any query, Please let us know.